(Información remitida por la empresa firmante)

Consistent with its strategy, Euroclear is now exploring further opportunities as it continues the integration of MFEXbyEuroclear to build a compelling proposition for funds services. This includes services in private markets assets, where Euroclear has announced its intention to acquire Goji, a UK-based FinTech (subject to regulatory approvals). A further innovation was delivered in the Negotiable European Commercial Paper Market as Euroclear France opened its services to Italian issuers for the first time. By using the service, Unicredit became the first issuer to access the second largest short-term funding market in Europe.

Implications of Russian sanctions

Russia’s invasion of Ukraine resulted in market-wide application of international sanctions, which had a material impact on Euroclear’s financial market infrastructure. Well established processes are in place which have allowed the group to implement the sanctions while maintaining the normal course of business.

There is, however, additional complexity because the package of sanctions is wide-ranging and, moreover, Russia does not recognise the international sanctions and has implemented its own economic countermeasures. Euroclear maintains regular dialogue with clients and other impacted stakeholders in managing the market issues and implications of Russian countermeasures.

The international sanctions and Russian countermeasures resulted in a loss of activities from sanctioned clients and Russian securities which impacted business income. However, it has been more than offset by increased interest income.

The cash on the balance sheet has increased as blocked coupon payments and redemptions accumulate. At the end of March 2023, Euroclear Bank’s balance sheet had increased by EUR 88 billion year-on-year to a total of EUR 140 billion.

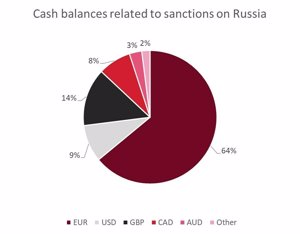

As per Euroclear’s standard process, which is the same for any client’s long cash balances, the cash balances arising from the sanctions are invested to minimise credit risk. Over Q1 2023, interest arising on cash balances from Russia-sanctioned assets was EUR 734 million.

Future earnings linked to the sanctions will continue to depend on the prevailing interest rate environment and the evolution of the sanctions. The Board expects interest income to continue to grow as blocked payments and redemptions continue to accumulate, albeit at a slower pace during 2023.

As previously outlined, while the Russian sanctions materially impact the balance sheet, the impact on the group’s capital ratios is not expected to be significant. Euroclear maintains a strong capital position.

The nature of the activities undertaken as a financial market infrastructure has led various parties to contest the sanctions and countermeasures, as well as their application, with legal proceedings ongoing in both the European Union and Russia. At present these legal proceedings are not presently considered a material risk and have not incurred any financial impact.

Furthermore, Euroclear notes that analysis is being undertaken by the European Commission to consider the potential generation of resources to support Ukraine from reinvestment of immobilised Russian assets.

Since considerable uncertainties persist, the Board considers it necessary to separate the sanction-related earnings from the underlying financial results when assessing the company’s performance and resources.

Euroclear continues to act in a transparent manner with all authorities involved. The Board will continue to act cautiously by not distributing any profits related to the Russian sanctions until the situation becomes clearer.

Annexes

Euroclear Bank and Euroclear Investments are the two group issuing entities. The summary income statements and financial positions at Q1 2023 for both entities are shown below.

Note to editors

Euroclear group is the financial industry’s trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency and connections to financial markets for sustainable economic growth. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation, and efficiency at scale for its global client franchise. The Euroclear group comprises Euroclear Bank, the International CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden, Euroclear UK & International and MFEXbyEuroclear.

Photo – https://mma.prnewswire.com/media/2064804/Cash_balances.jpg

Photo — https://mma.prnewswire.com/media/2064810/business_as_usual.jpg

Logo — https://mma.prnewswire.com/media/832898/Euroclear_Logo.jpg

View original content:https://www.prnewswire.co.uk/news-releases/euroclear-publishes-another-quarter-of-growth-in-q1-301810606.html