(Información remitida por la empresa firmante)

BRUSSELS, April 28, 2023 /PRNewswire/ — Results for the Quarter Ending 31 March 2023

Highlights

Delivering growth in the first quarter

Progress made in delivering Euroclear’s client-centric strategy, with a continued focus on resilience as a global financial market infrastructure

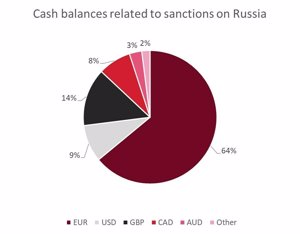

Q1 net profit totalled EUR 796 million, including interest earnings on cash balances arising from the application of international sanctions related to Russia

Operating income was EUR 1,380 million, an increase of 215%

Business income of EUR 409 million (Q1 2022: EUR 405 million) and interest, banking, and other income of EUR 971 million (Q1 2022: EUR 32 million) reflect resilience of diversified business model driven by underlying revenue growth

Strong underlying financial and business performance

Excluding the impact of the Russian sanctions, underlying Q1 net profit increased 95% to EUR 256 million

Underlying operating income was EUR 651 million, an increase of 51% year-on-year

Underlying business income reached a record EUR 414 million, up 2% year-on-year, with three-year underlying business income CAGR of 9% reflecting the robust growth delivered through volatile financial market conditions

On an underlying basis, quarterly interest, banking, and other income increased by 871% to EUR 237 million due to rising interest rates

Investment in Euroclear’s strategy, coupled with higher inflation have led to underlying operating expenses increasing to EUR 307 million, up 19% compared to the prior year

On an underlying basis, earnings per share rose by 95% to EUR 81.4 per share.

Commenting on the results

Lieve Mostrey, Chief Executive Officer, Euroclear

“We are pleased that Euroclear has delivered another quarter of growth. Our diversified and robust business model continues to serve our stakeholders well, enabling further investment in our client proposition and business resilience as we implement the group’s growth strategy.”

Financial summary

Euroclear delivered another record financial performance in Q1 2023.

In total, Q1 2023 net profit increased to EUR 796 million, benefitting from the continued delivery on the group’s strategy and its resilient business model, and the impact of Russian sanctions which contributed materially to the financial results.

Further details on the implications of the Russian sanctions are included in a dedicated section later in the release.

Underlying results

Underlying Q1 operating income rose 51% to a record EUR 651 million.

Most of the group’s operating income came from products and services that generated fees. Business income improved through the quarter to reach a record EUR 414 million, an increase of 2% year-on-year.

The Euroclear group’s business model provides a hedge against market volatility. When equity markets are lower, the impact is mitigated by the group’s diversified and subscription-like business model, and we benefit in a similar vein when bond markets are weaker, as approximately three quarters of the group’s business income is decoupled from financial market valuations. Such that, in the recent market environment, when both equity valuations and transaction volumes have been low, any potential impact to us has been mitigated by those operating entities which have a greater relative weighting to the bond markets, which saw business income grow.

Over a three-year period, underlying business income has grown 9% CAGR, reflecting the robust growth delivered by the strategy through volatile financial market conditions.

Since last year, the interest rate environment has changed dramatically. This has resulted in a large increase in interest earnings due to rising interest rates on cash balances. On an underlying basis, Q1 2023 interest, banking and other income increased by 871% to EUR 237 million because of rising interest rates.

Euroclear is investing in its strategy, leading to underlying operating expenses increasing to EUR 307 million, up 19% compared to the prior year.

Approximately 10% of the increase in underlying operating expenses is due to inflation on costs, with the remainder reflecting continued investments in its technology and service offering, as well as one-off projects. The investments in Euroclear’s technology aim at enhancing Euroclear’s client proposition, business resilience, and to increase efficiency through standardisation and modernisation.

Euroclear continues to expect expenditure to remain above its ‘through-the-cycle’ target of 4-6% p.a. throughout 2023, due to accelerating investment in both its strategy and the resilience of the business, coupled with continued inflationary pressures on the cost base. Excluding the impact of inflation and one-off expenditures, Euroclear’s Q1 expense profile is broadly in line with the top end of the through-the-cycle range.

Nevertheless, profitability has continued to rise, as expected, as inflation headwinds have been more than offset by higher net interest income from subsequent rate increases. The group’s underlying EBITDA margin was 57% in the first quarter, a level which is amongst the industry leaders in the financial market infrastructure sector.

On an underlying basis, earnings per share almost doubled, up 95% to EUR 81.4 per share.

The group maintains a strong capital position and a low-risk profile, which are critical as a financial market infrastructure and create headroom for further growth.

Navigating a Challenging Operating Environment while Delivering Euroclear’s Growth Strategy

Following a year in which financial markets experienced negative returns from both equities and fixed income for the first time in over 50 years, activity levels in the first quarter were relatively muted, with low levels of Initial Public Offerings in equity markets and an absence of M&A activity as a driver of capital market operations. Despite this, Euroclear has continued to grow its business income, demonstrating the resilience of its business model and the continued progress in its client-centric strategy.

Fixed income markets improved through the quarter, however equities remained volatile which has impacted the group entities and products, such as funds, where there is higher equity exposure. In addition, the higher interest rate environment has reduced demand for some product lines, such as in tri-party securities lending.

Euroclear has closely monitored the recent disruption in the banking sector, taking necessary actions to ensure its resilience and support clients where appropriate. The volatility resulted in higher transaction volumes in March at a similar level to last year, following Russia’s invasion of Ukraine.

In addition, following the market-wide application of sanctions related to Russia, Euroclear continues to comply in its role as financial market infrastructure. See “Implications of Russian sanctions”, below, for more details.

The consequence of the operating environment is shown below in the group’s key operating metrics:

At the same time, Euroclear has continued to deliver on its five-year growth strategy and strives towards its ambitious long-term vision to build a digital and data-enabled financial market infrastructure.

In line with this vision, Euroclear recently announced a collaboration with Tradeweb and Informa Global Markets to automate the identification and setup process for newly issued Eurobond securities in the primary market. The initiative is expected to reduce cost and risk to the investor community by providing quicker access to reliable deal information.

(CONTINUA)